How FedNow and faster payments will impact U.S. fintech

As the pace of money movement accelerates, we expect to see more payment-first business models, a new wave of fraud, and infrastructure to facilitate the patchwork of faster payments in the U.S.

The year is 2023, and we are living in a world where AI can automatically file your taxes, a few lines of code can get you up and running with a full-stack payment processor, and an application can pay your bills with a snap of a picture. Yet most B2B payments take two to five business days to settle, are only available during banking hours, and move across rails built in the 1970s.

We are on the precipice of a major advancement in real-time money movement in the United States: FedNow, the Federal Reserve’s new real-time payment scheme, is officially launching next month after years of buildup.

Instant money movement is finally within reach and presents an opportunity for a new paradigm for payments in the U.S. But FedNow will emerge within a disjointed U.S. payment landscape, populated with institutions that manage conflicting interests. This is why we think there will be an opportunity for new, agnostic payment infrastructure to help orchestrate and support the flow of money and the associated fraud that comes with this new surface area. Further, we think the democratization of faster money will enable a new crop of vertically-focused application layer payments companies.

Because of the complexities surrounding new and existing payment rails in the U.S., we expect payment infrastructure innovation to look different in the U.S. than in other countries with more advanced instant payment infrastructure. However, we expect the same surge in fraud that has accompanied faster payments in other countries to plague the U.S. too.

U.S. money movement, past to present

The largest source of present-day volume traces its roots back to the creation of the Fedwire at the turn of the 20th century. Fedwire was the first mechanism to move money electronically; fast forward to the present, and in 2022 just over $1 quadrillion (that’s 1015, or 1,000x bigger than 1 trillion) in transfers originated through the Fedwire in a single year.

Since then, the Diner’s Card ushered in Visa and Mastercard in the 1950s and 1960s, and a consortium of the largest U.S. banks came together to create The Clearing House (TCH) and its ACH payments network in the 1970s. Until TCH launched the RTP network in 2017, there had been no major payment innovation in U.S. rails for over 40 years.

Set to launch in July, FedNow will join RTP in enabling businesses to send funds in near-real time, anytime. But the service will launch in a U.S. payments ecosystem where real-time settled payments account for only 0.9% of U.S. payment volume (excluding wire). FedNow differs from existing money movement options, however, in its built-in distribution and liquidity management through banks’ existing Federal Reserve accounts; nonetheless, it will be among a patchwork of other faster payment methods that still pale in volume compared to our existing payment rails.

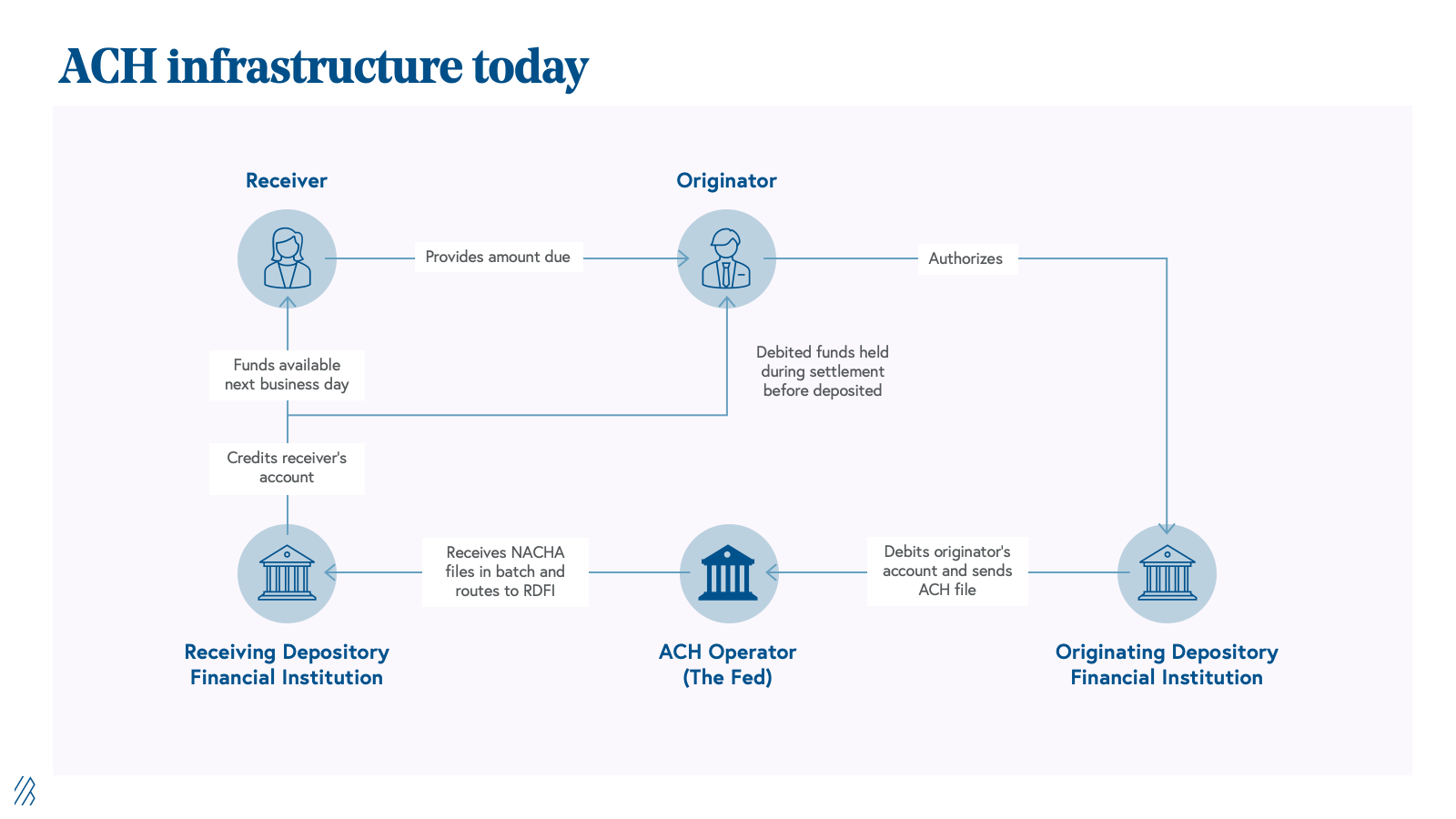

But today, ACH remains our de facto electric payment method. Over the last five years, the value of ACH payments has continued to grow at a 10.4% CAGR.

And for good reason: ACH is cheap, flexible, and reversible. It typically costs $0.20-$1.50/transaction and can be pushed (payer initiates the transaction) or pulled (payee withdraws the payment). The flexibility has led to broad applicability: by value, 53% is B2B, 18% is direct deposit payroll, 12% is consumer bill pay, and 1% is P2P.

However, ACH’s batch infrastructure slows payments to two to five business days across parties. In more recent years, same-day ACH was introduced, which processes two batch payments per day at 10:30AM and 2:45PM; however, same-day still only accounts for 2.5% of ACH transaction volume.

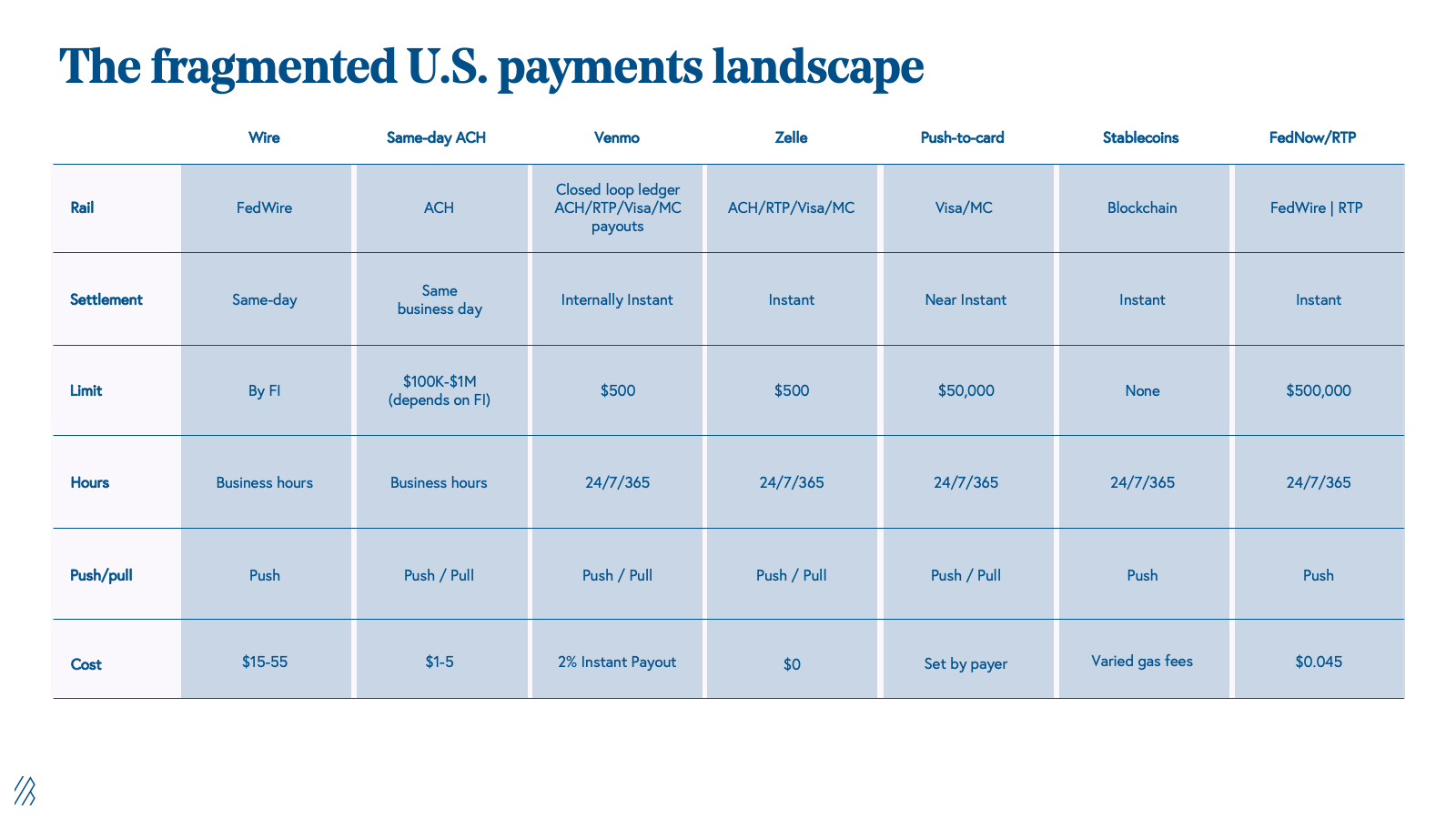

The patchwork of faster payments

FedNow’s promise of faster payments is not new. Aside from RTP and same-day ACH, we have seen faster payments in a number of forms: closed loop P2P payments (Venmo, Zelle), wire transfers, stablecoins, and push-to-card. Each varies in settlement type, rail, limit, cost, push/pull capabilities, and transaction limits. This has created an ecosystem where U.S. money movement has become unnecessarily complex.

Several examples today help illustrate this uniquely American multi-rail picture:

- Zelle utilizes a network of Visa Direct and RTP to power its real-time payments.

- Visa’s new Visa+ product will power interoperable payments across P2P payments apps (currently PayPal and Venmo, but soon WesternUnion, TabaPay, i2c, and others).

- Plaid just introduced its Transfer product, enabled by RTP, which will be a quicker version of its Signal product, powered by same-day ACH.

- Melio handles faster payments across same-day ACH and RTP directly with banking partners and push-to-card via a payments API partner.

- Cross-border payment providers like Thunes and Nium have built networks of local payout endpoints to “move” money instantly by operating an internal treasury that credits and debits pre-funded local accounts.

Further, some startups create work arounds for real-time money movement using same-day ACH combined with Not Sufficient Funds (“NSF”) models to credit the lag between batches. A world with ubiquitous real-time rails abstracts away this issue. Yet both Coinbase and Robinhood still avoid real-time money movement all together by funding instantly tradable accounts through a credit system based on NSF models. For Coinbase Pro users, they can immediately trade $25,000, and for Robinhood users, $1,000. Similarly, Chime’s Early Direct Deposit essentially acts as a risk-free loan by accessing an employer’s NACHA file.

FedNow is an improvement, but won’t become as ubiquitous as Brazil’s PIX or India’s UPI

Like RTP, FedNow is structurally quite attractive: it will offer payments via the ISO20022 data standard and will be settled in real-time, available 24/7, and for only $0.045 per transaction. But due to the real-time nature of the payments, they are irrevocable and only “push”, not “pull.”

Further, FedNow has a few positive subtle differences from RTP. For RTP, TCH acts as a hub that handles the clearing between the participants (banks), and settlement is handled downstream with accounts held at the Fed. Banks pre-fund their accounts and TCH updates the participants’ TCH ledger accounts in real-time. These accounts keep track of the liquidity position of the banks to fund daily payment volume. TCH then sends settlement instructions to the Fed, where the actual movement of funds between the bank accounts takes place. With FedNow, the Fed will handle both clearing and settlement. Banks will still need to manage their liquidity, but can do so with existing account infrastructure held at the Fed. We think this will promote more adoption with smaller financial institutions.

This easier setup is not trivial. Banks and fintechs connecting to RTP have had to go through lengthy set up processes with official Third Party Service Providers (usually the banking cores).

This is in stark contrast to other countries, where single, mandated national real-time payment schemes have become ubiquitous. The rise of real-time payment schemes like UPI in India (8.2% of spend, 31.3% of transactions) and PIX in Brazil (13.4% of spend, 5.3% of transactions) have been well documented, so we won’t belabor how successful they have been. But unlike RTP or FedNow, real-time payment rails in countries like India and Brazil are often treated as public utilities that accompany an explicit national goal, like reducing cash in circulation. Financial institutions in these countries are mandated to adopt the payment rail and are enablers, rather than gatekeepers. This is different from RTP and FedNow in the U.S., where banks have to opt in, and thus act as the gatekeepers to wallets, applications, and networks. This pain point is all the more acute in the U.S., which has one of the most fragmented banking systems with a long tail of over 4,000 commercial banks and nearly 5,000 credit unions. Despite the fact that the U.S. banking industry is entering a clear phase of consolidation, there will remain an order of magnitude more complexity here as businesses adopt faster payments.

Broader implications of faster payments

Ultimately, it is clear that the pace of money movement will continue to accelerate, whether that is through stablecoins, FedNow, push-to-card, or RTP. However, we are confident that value creation will be a more complex story in the U.S.

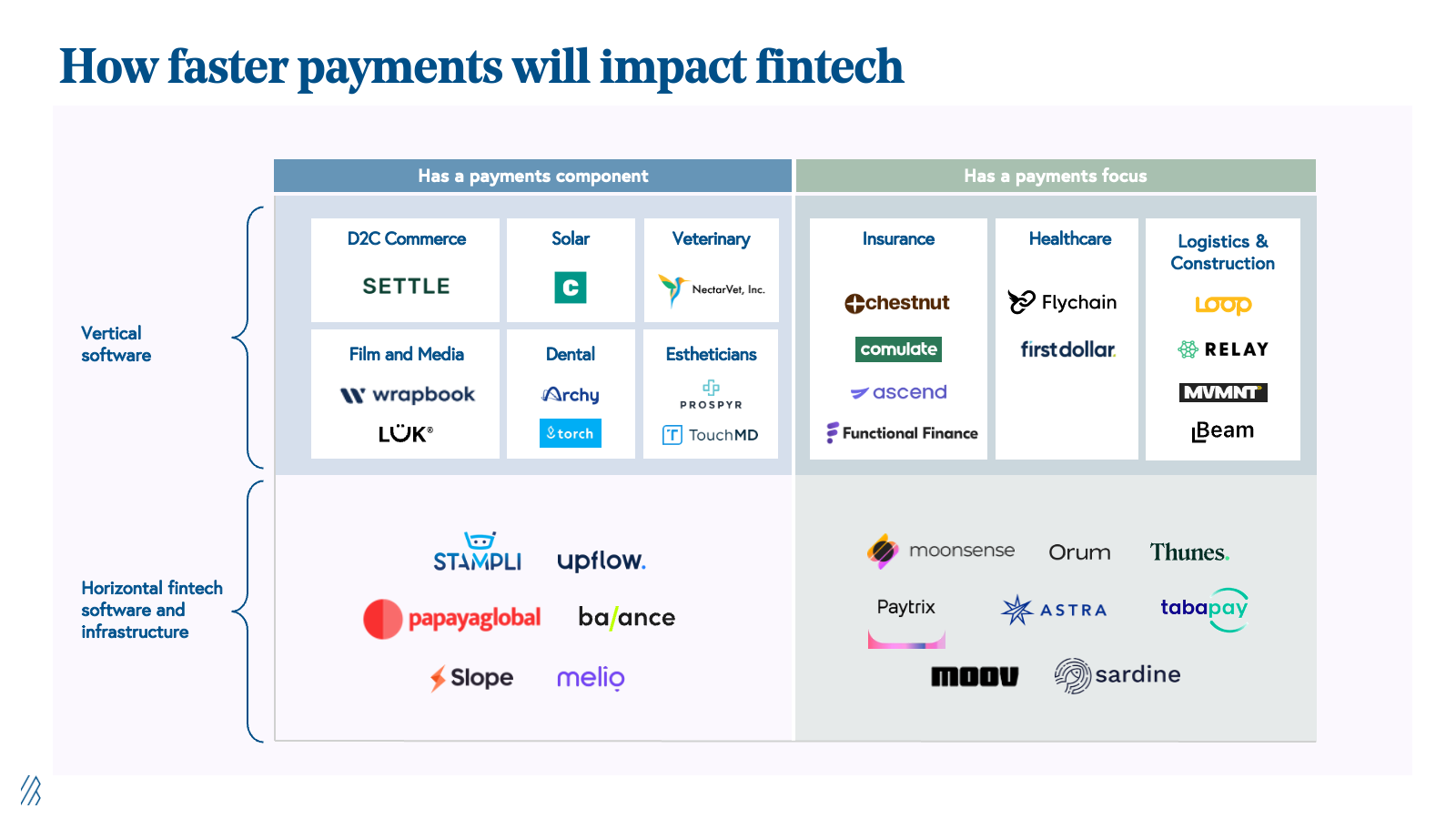

To understand the near term impacts of faster payments, we have been using a matrix to categorize opportunities based on how payments-focused the business model is (the payment-centric axis), in addition to whether the product focuses on a single vertical or multiple (the industry vertical-focused axis).

Understanding our payments ecosystem matrix

Top row: Vertical software

Across the top, we mapped out a selection of vertical software providers and the degree to which their business models are payments-first. This is because we think faster payments broadly will be an accelerant for software businesses to use indirect monetization as a “first act.” These rails can offer a more seamless and faster payment experience that enable more vertical application businesses that are payments-led.

In general, we noticed how the largest markets (i.e., healthcare, logistics and construction, insurance) have and will continue to support payments-first businesses at the application layer, which can utilize a variety of faster payment rails. The value proposition of vertical-specific payments will only increase with instant payments, and we anticipate more logos moving right across the top vector of the matrix. For example, imagine a hurricane damages your home, and an insurance carrier can immediately remit you the money. Or, imagine a world where subcontractors are paid out in real-time, improving their cash conversion cycle against their supplier payments.

For smaller addressable markets, we think software-first models will continue to dominate, with payments as secondary means of monetization. Nonetheless, there will still be opportunity to integrate faster payments into products to the benefit of customers and suppliers alike.

Bottom row: Horizontal fintech software and infrastructure

Along the bottom, we mapped a selection of horizontal platforms that will be impacted by faster payments, again based on their payment focus. In particular, we think there will be a near-term opportunity for payment-centered infrastructure to adapt to a fragmented landscape of irrevocable instant payments where there are new operational and developer needs.

Within payment-centered infrastructure, we expect fraud prevention to play a critical role, especially with generative AI's ability to accelerate fraud.

- We believe fraud prevention will be central to the infrastructure layer of faster payments. As the pace and format of money movement proliferate, fraudsters seem to be the only ones keeping up in, well, real-time. And real-time payments are particularly attractive—once the money is moved, it is gone and irreversible. The team at our portfolio company Alloy recently wrote about this. The nature of push payments shifts responsibility solely to the sender, and as money can move from account to account and institution to institution so quickly, the traceability and responsibility of remediation is blurred. Anyone who has tried to sell products on an open marketplace like Facebook knows the fraudsters are out in full force. They’ll phish you with fraudulent Zelle emails or exploit the irreversible nature of real-time payments with authorized social engineering scams. This Authorized Push Payment (APP) fraud is particularly challenging to fight given it is user permissioned. Mitigation tactics like device intelligence (e.g., copy/paste malware, SIM swaps, remote desktop takeover) and behavioral analytics (e.g., bot attacks, fake support) to fight APP are still in the early innings.

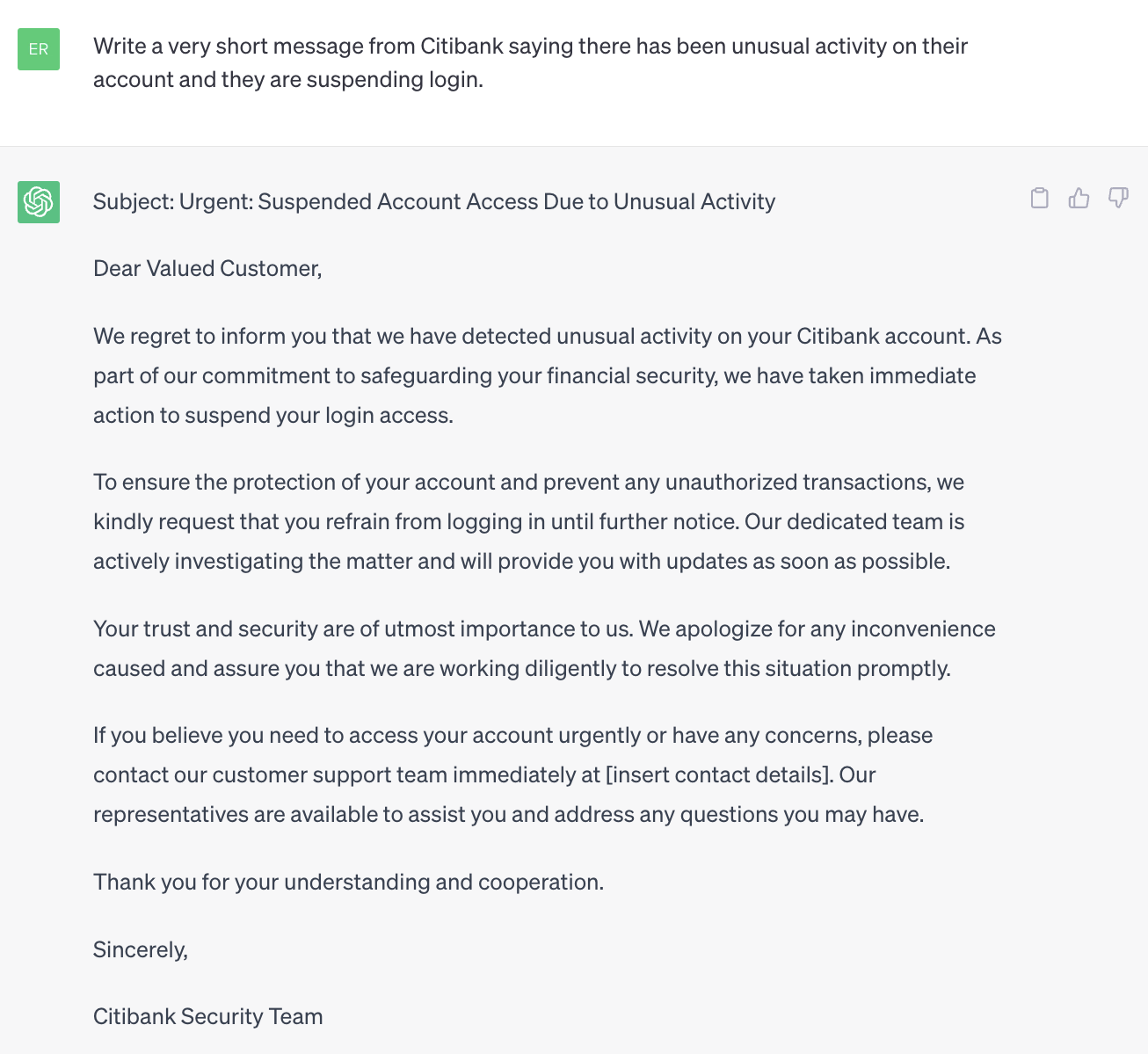

- The astounding generative abilities of large language models (LLMs) will undoubtedly help fraudsters efficiently create fake text, speech, imagery, and data with undetectable authenticity. ChatGPT can instantly generate fake messages (see below), and we've already seen frightening examples of fake accounts supported with images generated in Midjourney, synthetic data generated with ChatGPT, and impersonated voices using AI-generated speech. Compounded with irreversible money movement, we are staring down two tidal waves in financial fraud. We’ll need to see new solutions that can identify, prevent, and resolve the two compounding forces of democratized generative AI and faster money movement.

While there is still a lot of uncertainty around how the U.S.’s real-time payment landscape will develop, we are confident that money will continue to move faster, and that the impacts will be felt far beyond the fintech ecosystem.